Solid-state battery welcomes another milestone breakthrough!

At present, there are 7 GWh production lines under construction, and more than 30 pilot lines have been put into operation, and the competition in the industry has already started in advance.

China’s solid-state battery field recently came heavy news, realized a milestone new progress. Not long ago, Anhui Anwa New Energy Technology Co., Ltd, in which Chery Group has a stake, announced that the first engineering samples of its self-developed GWh-grade new solid-state battery production line have successfully rolled off the production line. This news means that China’s current GWh solid-state battery production line is expected to increase to 7, while there are more than 30 solid-state battery pilot line in the synchronized promotion.

The smooth implementation of these projects, on the one hand, highlights the domestic solid-state battery industry is in a stage of rapid development, on the other hand, also shows that the solid-state battery has not yet officially listed, the competition in the industry has been kicked off in advance.

01 Chery shares, 1.25GWh semi-solid-state battery project attracted attention

The successful output samples of GWh solid state battery production line, belonging to Anhui Anwa New Energy Technology Company. The company was established in 2020, by Chery, Guoxuan Gaoke, the United States 24M, Thailand GPSC, Japan Azeba and other companies to jointly invest in the establishment. This is not only an important attempt by Chery to lay out in the field of solid-state battery technology, but also an active exploration of domestic introduction of overseas advanced solid-state battery R&D technology.

From the performance point of view, the total length of this production line is more than 35 meters, and the designed capacity reaches 1.25GWh. According to the technical parameters disclosed by the enterprise, this production line not only greatly simplifies the production process of traditional lithium batteries, but also adopts positive and negative electrode dry manufacturing technology, which reduces the investment in fixed assets by 30%, and reduces the energy consumption by nearly 20%. In addition, the production line adopts high-pressure coating technology, which can be adapted to slurries with different solid contents, and together with the dynamic feedback control system, it can realize micron-level coating precision.

As far as products are concerned, the line is mainly used for the production of semi-solid state batteries. The first batch of the new solid-state 1.0 battery prototypes to come off the production line has passed the new national standard GB38031-2025 and the stringent pin-prick test. With the design of no flowing electrolyte, the battery realizes the ultra-high safety performance of “non-flammable and non-explosive”. The energy density of the first-generation product has exceeded 300Wh/kg, the second-generation 400Wh/kg prototype has entered the trial production stage, and we plan to launch the third-generation all-solid-state battery with an energy density exceeding 500Wh/kg in 2027.

In terms of industrial scale, the GWh-grade new solid-state battery production line is only a part of the company’s planned 5GWh solid-state new-generation battery R&D center and highly integrated automated production line. At present, Anwar New Energy is cooperating with Wuhu Economic Development Zone, with an estimated total investment of 1.8 billion yuan, and will also build a new solid-state battery industrial park project. With the successful commissioning of this GWh-grade new solid-state battery production line, it not only lays a solid foundation for the company to realize mass production within the year, but also provides more solutions for new energy vehicles, energy storage power stations and low-altitude economy.

02 Full force, 7 GWh production lines under construction

The year 2025 is destined to be the year when solid-state batteries will be in full force and accelerate mass production. Up to now, the number of new GWh-grade semi-solid/solid-state battery production lines in China is expected to increase to seven. The advancement of these projects marks a milestone in the field of solid-state battery manufacturing in China.

First is Qingtao New Energy, which built the country’s first solid-state lithium battery production line in 2018, with a capacity scale of 0.1 GWh. in 2019, it signed a project with an annual production capacity of 10 GWh of solid-state lithium batteries, to be constructed in two phases, with one phase of 1 GWh and two phases of 9 GWh. of these, the first phase has been built into the world’s first scaled-up mass-production line of 1 GWh solid-state lithium power batteries in 2020.

Next is the GWh-grade new solid-state battery production line of Weilan New Energy. The project was jointly invested by Weilan New Energy, Enjie Group and Tianmu Pioneer in 2021, with a total amount of 1.3 billion yuan, and it is expected that by 2026, the capacity will reach 20GWh.

The third is Hui Energy Technology, which realized a capacity of 1GWh of semi-solid-state batteries in 2021.

Fourth is Ganfeng Lithium, which launched a 200 million Wh solid-state lithium battery pilot production line construction project in 2018.In 2019, it completed the commissioning of its first-generation solid-state battery production line with an annual production capacity of 0.3GWh.In 2022, a solid-state battery production line with a scale of up to 2GWh was completed and put into operation.

Fifth is Hive Energy, which plans to realize the application of solid-state batteries with energy density of 350-500Wh/kg in mass-production vehicles in 2025.

Sixth is Sinosolid Era, which plans to start the construction of a pilot line for solid-state batteries in 2025, and is expected to put it into operation in October, and then plans to start the construction of a production line for 2GWh ultra-large-capacity solid-state batteries by the end of the year. Seventh is Heyuan Lithium, which launched the construction of 1GWh solid state battery mass production line in Huai’an, Jiangsu Province in 2025, and plans to build 10GWh solid state battery production line in three phases, and expects the products to be rolled out of the production line in November 2025.

In addition, in addition to these companies that have clearly announced the start of GWh-grade solid-state battery production line construction, there are more than 30 solid-state battery pilot lines in the synchronized promotion. Battery and automobile enterprises such as Ningde Times, YWL, Guoxuan Gaoke, Xinwangda, Vonergy, SAIC, Changan Automobile and so on have also announced the mass production plan of solid-state batteries. 2025 to realize the semi-solid-state batteries on board the car in mass production, and 2027 to realize the full-solid-state batteries off the line of the pilot test, which has become a common expectation of the market and the industry. According to the forecast of relevant organizations, by 2027, China’s solid-state battery shipments may reach 18GWh, and the domestic solid-state battery industry chain enterprises have exceeded 280; by 2030, the proportion of solid-state batteries in the composition of new energy vehicles and energy storage electrolyte material system may reach about 10%.

03 The chain reaction is obvious, the pattern of material and equipment field will be reshaped.

The rapid mass production of solid-state batteries and the successive completion of GWh-grade solid-state battery mass production lines will greatly change the pattern of the current battery industry chain. Especially in the two core areas of materials and equipment, the change is particularly significant.

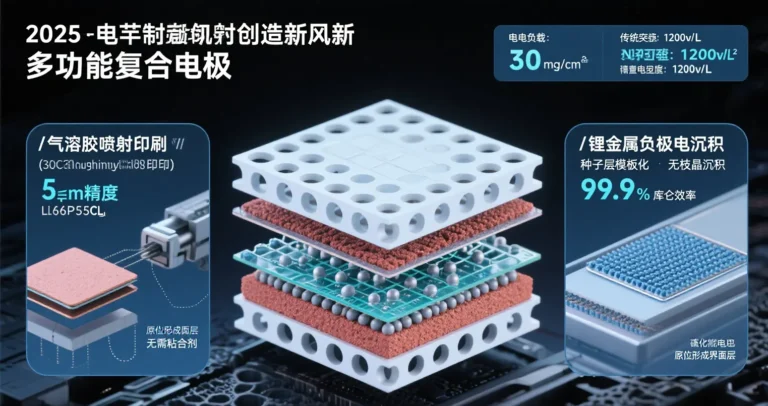

In terms of anode and cathode materials, the combined application of high-nickel ternary and lithium-rich manganese-based materials and silicon carbon anode or lithium-metal anode materials is raising the energy density of solid-state batteries from 300Wh/kg to 400Wh/kg, which not only ushers in new development opportunities for the traditional ternary materials head enterprises such as Rongbai Science and Technology and traditional cathode enterprises such as PuTaiLai and Beret, but also for lithium resource enterprises such as Ganfeng Lithium, who have found a new way to develop their business in the upstream. Upstream lithium resource enterprises have also found a new market positioning.

In the field of diaphragm and electrolyte materials, the application of technologies such as high-strength composite film, ceramic coated film and even skeleton film is prompting traditional diaphragm giants such as Enjie shares and Xingyuan materials to re-enter the field of solid-state batteries.

In the field of electrolyte, polymer, oxide and sulfide, the three technology routes have made rapid breakthroughs, and the three combined with each other, complement each other’s strengths and weaknesses, and is rapidly shortening the distance between the technology and practical applications. Among them, Qingtao Energy, Weilan New Energy and other enterprises use the “oxide + polymer” composite route, combining the high conductivity of the oxide and polymer flexibility advantages, together to enhance the conductivity and stability of the solid-state battery solid-solid interface.

In addition, in terms of composite collector materials, by plating nickel and ceramic materials sequentially on the surface of copper foil to form a gradient transition layer, which solves the problem of interfacial separation between the solid-state electrolyte and the collector due to different coefficients of thermal expansion. The latest samples of the composite collector head enterprises, such as Nordic shares, Telford Technology, Jiayuan Technology, and Guangpu shares, are being sent to solid-state batteries and semi-solid-state battery manufacturers for inspection and testing.

It can be said that, at the level of research and development of the material system, the changes in the industry for all to see, the traditional enterprises to accelerate the transformation to reshape the industrial landscape of the demand is very urgent. In the field of equipment, the competition is even more intense.

High-precision stacking machine, dry integrated machine, high-pressure formation equipment and other new equipment has entered the supply system of the head manufacturers, Li Yuanheng, Jatuo Intelligence, Honggong Technology, Pilot Intelligence, Mannstar and other companies have received substantial orders to verify. More than 30 solid-state battery pilot line synchronization, solid-state batteries are not yet on the market, the competition between equipment manufacturers has begun in advance.

Dry process and equipment as an example, solid state electrolyte in the whole process of manufacturing, the water control requirements are extremely strict, which makes it difficult to meet the needs of the traditional lithium battery electrode wet preparation process. Even if the drying process is added later, it will not only significantly increase energy consumption, but also difficult to achieve complete drying. Therefore, the dry electrode process and equipment has become the key to solid-state battery production.

However, compared to the wet process, the difficulty of the dry process is almost exponential. Even Tesla, which has strong technical strength, proposed the dry process in 2020, but it is still difficult to realize mass production until 2024. In this field, technological breakthroughs, product consistency guarantee, yield control and cost control are forming a new competitive focus around solid-state batteries.

China’s solid-state battery development is booming