Explosive Demand for Energy Storage Lithium Batteries Drives Restructuring of LFP Battery Industry Supply-Demand Dynamics

The global energy storage lithium battery market is growing at an annual rate exceeding 100%, with lithium iron phosphate (LFP) battery capacity utilization rates surpassing 80% for the first time since 2022, signaling a new high-growth cycle for the industry.

The second half of 2025 marks a pivotal turning point for the lithium iron phosphate battery sector. Driven by unexpectedly explosive energy storage demand, the industry’s supply-demand dynamics are undergoing profound transformation. Major battery manufacturers including EVE Energy, Guoxuan High-Tech, and CALB have seen their stock prices surge by 50%-80% within just over a month, significantly outperforming broader market indices during the same period.

J.P. Morgan’s report “China Battery Supply Shortage Emerges” highlights that surging demand for energy storage batteries is reshaping the LFP battery sector. Currently, one out of every two LFP batteries is deployed in energy storage applications, marking the industry’s official entry into a new developmental phase.

I. Explosive Growth in the Global Energy Storage Market

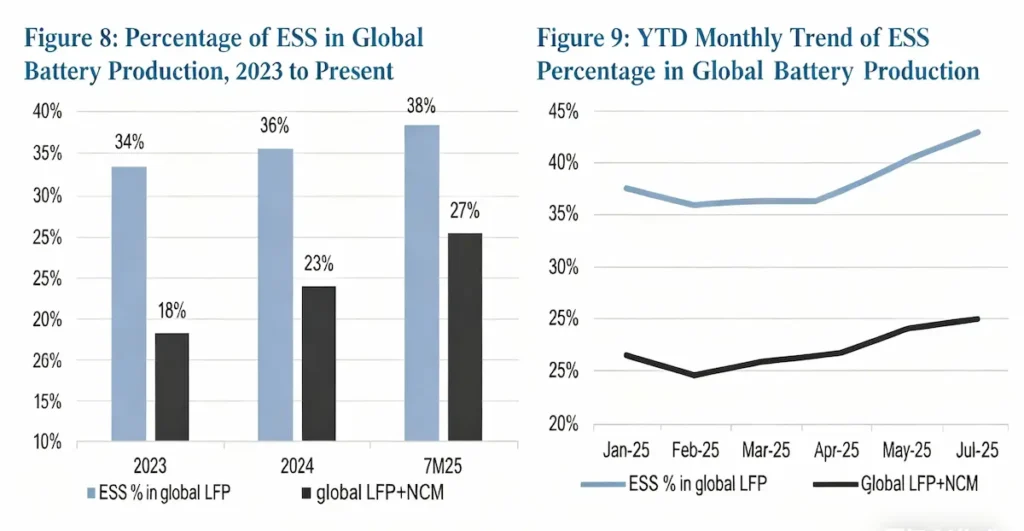

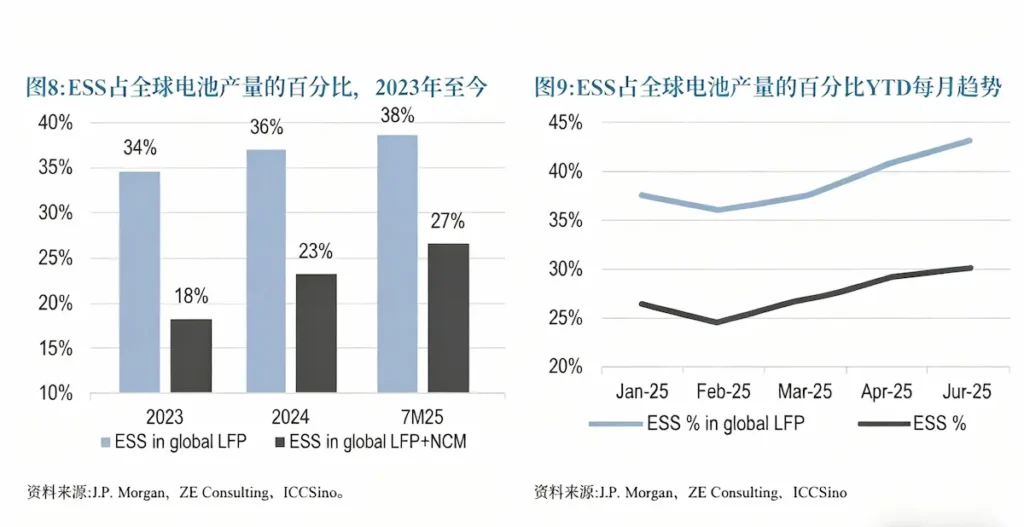

The energy storage market is rapidly expanding worldwide. Data indicates that by 2025, energy storage systems accounted for 27% of global battery production, showing a steady upward trend from 23% in 2024 and 18% in 2023.

Notably, after June 2025, lithium iron phosphate batteries for energy storage accounted for over 40% of global production of this battery type, indicating that demand for LFP batteries in the energy storage sector has entered an explosive growth phase. This surge is primarily driven by the accelerated global energy transition and the substantial increase in renewable energy installed capacity.

According to data from the Zhongguancun Energy Storage Industry Technology Alliance, China’s cumulative installed capacity of new energy storage reached 101.3 GW in the first half of 2025, doubling year-on-year and surpassing the 100 GW threshold for the first time. This capacity is equivalent to 4.4 times the installed capacity of the Three Gorges Dam.

II. Technical Approach and Performance Advantages

Lithium iron phosphate batteries hold an absolute dominant position in the energy storage sector. By 2024, they accounted for a staggering 92.5% of global energy storage batteries, establishing themselves as the industry’s preferred technical solution.

This advantage stems from their high safety and extended cycle life. Operational data reveals that energy storage systems utilizing high-density LFP batteries exhibit a capacity degradation rate of only 4.7% after two years of operation—significantly outperforming the 8% upper limit required in tenders.

Technological iteration continues to advance, with high-density LFP emerging as the new industry trend. Fourth-generation high-density LFP typically achieves packing densities of 2.6 g/cm³ or higher, delivering significantly greater energy density than traditional products. This perfectly aligns with new energy vehicle users’ demands for extended range and rapid charging capabilities.

III. Capacity Utilization and Price Recovery

The explosive growth in energy storage demand has significantly improved the industry’s supply-demand dynamics. By 2025, the overall capacity utilization rate of the top ten battery manufacturers exceeded 80%—the first time since 2022.

Leading companies demonstrated even stronger performance, with CATL, BYD, EVE Energy, and others achieving capacity utilization rates above 80%. Some production lines even operated at full capacity. This surge is primarily driven by robust energy storage market demand, with Chinese companies shipping 233.6 GWh of energy storage batteries globally in the first half of 2025.

Amid rising demand and escalating raw material costs, battery prices have begun to rebound. Starting in Q2 2025, energy storage battery prices entered a recovery phase, with industry-wide price increases of 0.02-0.03 yuan/Wh observed by July.

IV. Diversified Growth Across Global Markets

The surge in energy storage demand is unfolding in a globally diversified pattern, with China, the United States, and Europe emerging as the primary growth engines.

In China, provincial-level capacity compensation policies and differentiated electricity pricing have significantly boosted the investment return rate of energy storage projects, stimulating enthusiasm among local governments and enterprises.

Despite tariff policy challenges, the U.S. market maintains robust domestic demand for energy storage products. Chinese battery manufacturers continue to gain market favor through mature technology and stable production capacity.

Europe experiences explosive demand in both residential and utility-scale energy storage projects. Subsidy programs and tax incentives introduced across multiple countries attract substantial corporate participation in energy storage project tenders.

V. Changes in Industry Competitive Landscape

The lithium iron phosphate industry is undergoing structural differentiation. Leading companies maintain over 70% capacity utilization rates leveraging technological, financial, and supply chain advantages, while numerous small and medium-sized manufacturers face idle capacity issues with utilization rates below 30%.

CATL and BYD have established a duopoly, collectively holding over 60% market share. Leading firms frequently secure multi-billion-yuan contracts, such as the supply agreement between Wanrun New Energy and CATL, which stipulates the delivery of approximately 1.3231 million tons of LFP products from May 2025 to 2030.

Rising technical barriers are accelerating industry consolidation. Only a handful of companies can supply high-density LFP batteries due to technical barriers, granting them significant advantages in processing fees and profitability over standard LFP batteries. This product currently commands a premium of 1,000-3,000 yuan per ton.

VI. Future Development Trends and Challenges

In the short term, first-tier battery manufacturers are expected to further expand their market share by leveraging their production capacity and order acquisition capabilities. Second-tier manufacturers, however, demonstrate greater focus in the energy storage sector, with EVE Energy and Zhongxin Innovation both accounting for nearly half of the energy storage battery shipments.

In the medium to long term, if global energy storage demand maintains an annual growth rate of 60%-80%, the industry may enter a new cycle of supply shortages. Even with aggressive capacity expansions by manufacturers, demand growth could still outpace expectations.

Technological iteration will become a key variable. By 2026, 587Ah batteries are projected to become the new industry benchmark, reducing unit costs by 1-2 cents compared to current 314Ah batteries.

However, the industry also faces risks and challenges. A slowdown in new energy vehicle demand due to factors like subsidy phase-outs could disrupt overall demand for lithium iron phosphate batteries. Additionally, shifts in trade policies across major markets may impact domestic battery manufacturers’ overseas business expansion.