Introduction to Solid State Battery Technology in China

Definition and Technology Classification of Solid-State Batteries

Solid-State Batteries (SSBs) use a solid-state electrolyte instead of the traditional liquid electrolyte to realize the conduction of lithium ions between the positive and negative electrodes. According to the electrolyte form, they can be divided into three categories:

Semi-solid-state batteries: electrolyte mass accounts for 5%-10%, retaining the diaphragm structure, as a transitional solution to full solid-state, with an energy density of 300-400 Wh/kg.

Quasi-solid-state batteries: electrolyte accounted for less than 5%, with ionic conductivity Increase to 10-³ S/cm, close to the level of liquid batteries.

Full-solid-state battery: completely eliminate liquid components, theoretical energy density of more than 500Wh/kg, and completely solve the risk of thermal runaway.

The mainstream technology route focuses on three major electrolyte systems:

Sulfide electrolyte: the highest room temperature ionic conductivity (10-² S/cm), but poor air stability, requiring nanoscale encapsulation process (e.g., the patent layout of Ningde Times and BYD).

Oxide electrolyte: high mechanical strength (e.g. ceramic electrolyte of Qingdao Energy), excellent thermal stability but lack of flexibility.

Polymer electrolyte: good processing performance (Weilan new energy technology route), but the ionic conductivity is low, the need for composite modification.

Technological breakthrough: from material innovation to interface regulation

1. Progress in core material R&D

Electrolyte innovation:

Institute of Metals, Chinese Academy of Sciences developed inorganic/organic composite electrolyte, which inhibits lithium dendrite penetration through polymer network and reduces short circuit risk by 80%.

Huawei’s patented doped sulfide material improves interfacial stability and extends cycle life to 1,300 times without degradation.

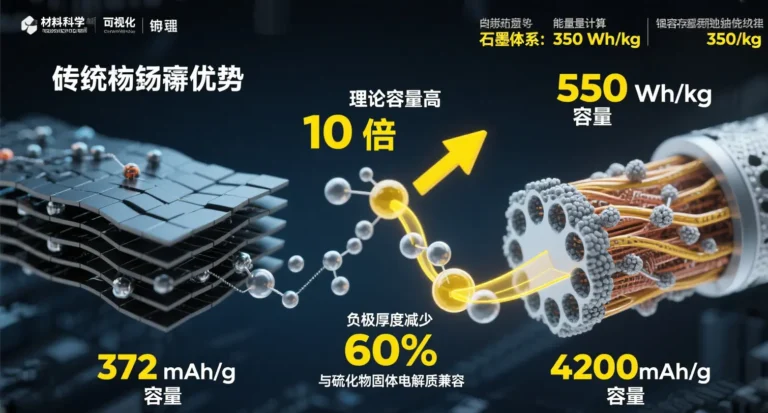

Anode breakthroughs:

Guoxuan Hi-Tech’s micro-nanochemical solid electrolyte combined with 3D mesoporous silicon anode, with a monomer energy density of 400 Wh/kg.

BYD’s staggered-layered electrode design optimizes the lithium-ion transmission path, supporting a range of 1200km.

2. Interface engineering and failure mechanism crack

short circuit mechanism revealed: CAS team through in situ electron microscopy found that the solid-state battery short circuit in two stages: lithium metal along the grain boundary defects growth triggered a “soft short circuit The growth of lithium metal along the grain boundary defects triggers a “soft short-circuit”, which eventually leads to an irreversible “hard short-circuit”.

Interfacial strengthening solution: 10 MPa stacking pressure is applied to optimize electrode/electrolyte contact, while ceramic coating (e.g. BYD patent) is used to alleviate stress cracking.

3. Manufacturing process upgrading

Guoxuan Hi-Tech has built the first 0.2GWh all-solid-state experimental line, with 100% localization rate of core equipment and 90% yield rate.

Dry electrode technology is applied on a large scale, reducing energy consumption by 30% and adapting to sulfide ultra-thin film preparation.

Industrialization Process: Chinese Companies’ Layout and Timeline

Chinese head enterprises seize the first opportunity in the track through technology route differentiation:

Ningde Times: focusing on the sulfide route, all-solid state small batch production will be realized in 2027, and cohesive batteries (500Wh/kg) have been used in electric aircraft projects.

BYD: sulfide all-solid-state battery is planned to be loaded in 2027, covering mainstream models in 2030, with capacity planning of over 50GWh.

Guoxuan Gaoke: Goldstone all-solid-state battery will land 2GWh mass production line in 2026, supporting high-end Electric vehicles and energy storage systems.

Rise of new forces: TaiLan New Energy launched 720Wh/kg all-solid-state samples and 12GWh capacity is under construction; Qingtao Energy oxide electrolyte batteries will come off the production line in 2027.

Capacity and cost planning:

By 2025, China’s solid-state battery planned capacity is over 400GWh, which can assemble 5 million EVs.

Through scale-up and process optimization, the target is to reduce the cost of all-solid-state to within 1.5 times of liquid batteries by 2030 (currently 3-5 times).

Application Scenarios: From New Energy Vehicles to Low Altitude Economy

1. In the field of electric vehicles,

semi-solid-state batteries have been installed in vehicles: ZhiGi L6 is equipped with Tsingtao energy batteries, with a range of more than 1,000 kilometers; Ningde Times “Blue Ocean Battery” is used in Vivo’s cell phone, with a 40% increase in low-temperature performance.

Consumer premium acceptance: long range models cost 100,000-150,000 yuan, promoting solid-state battery penetration rate.

2. Low Altitude Economy and Aviation

eVTOL (Electric Vertical Take-off and Landing Vehicle): Battery energy density is required to be >400Wh/kg, and solid-state batteries become the core option. Yihang Intelligent strategic investment in Xinjie Energy, Ningde Times cohesive batteries suitable for civilian electric airplanes.

CITIC Securities forecast: eVTOL market will drive the demand for solid-state batteries to 60GWh in 2030.

3. Energy Storage and Special Scenarios

Power grid energy storage: solid-state battery cycle life is over 8,000 times (Guoxuan Gaoke’s data), and the whole life cycle cost is lower than that of liquid batteries.

Deep-sea exploration and military industry: high-pressure resistance, wide temperature range (-50℃~150℃) characteristics to expand special applications.

Policy support and global competition pattern

National strategic input: China has set up a 6 billion yuan solid state battery special fund, and six enterprises including Ningde Times and BYD have been selected as the “national team”.

Local industry clusters: Guangdong, Jiangsu and other places launched 12 billion yuan project, covering electrolyte, dry electrode and other core links.

International competitive situation:

Japan’s Toyota and South Korea’s Samsung SDI aim to mass produce all-solid-state batteries in 2027.

China accelerates the counter-attack by virtue of the patent quantity advantage (sulfide patents up to 3 times of Japan) and industrial chain synergy.

Challenges and Future Prospects

Bottlenecks to be broken through

Interface impedance: solid-solid contact leads to 20% lower ion transfer efficiency than liquid batteries.

Cost pressure: sulfide electrolyte preparation cost is as high as $500/kg, which requires industry chain cost reduction.

Lack of standards: test specifications for all-solid-state batteries are not yet unified, affecting the commercialization process.

Key node in 2030

Technology target: energy density exceeds 500Wh/kg, cycle life exceeds 2000 times, cost reduced to below $100/kWh.

Market forecast: global demand reaches 643GWh, with China accounting for 60% share and output value exceeding 150 billion RMB.

Conclusion: The Global Mission of China’s Solid State Battery

China’s solid state battery industry is shifting from a “technology follower” to a standard setter. Through industry-academia-research synergies (e.g., nanosulfide electrolyte development at Academician Ouyang Minggao’s workstation) and vertical integration of the industrial chain, China is expected to realize the large-scale application of all-solid-state batteries by 2030. This energy storage revolution will not only reshape the pattern of new energy vehicles, but also promote the rise of new industries such as low-altitude economy and smart grids, and provide “China’s solution” for the global carbon neutrality goal.