China’s lithium battery technology development

China’s lithium battery industry has grown from a follower to a global leader in the field of new energy, and is in the world’s leading position in terms of technological innovation, industrial scale and market application. This article will comprehensively analyze the latest development of China’s lithium battery technology, from basic definition and classification to the most cutting-edge technological breakthroughs, and from industrial chain layout to global competition pattern, showing how China has consolidated its leading position in the global lithium battery field through continuous innovation. The article will focus on the latest progress of disruptive technologies such as solid-state batteries, sodium-ion batteries, and lithium-rich manganese-based cathode materials, analyze how leading companies such as Ningde Times and BYD build their competitive advantages through technological innovations, and look forward to the development prospects of Li-ion batteries in new energy automobiles, energy storage systems, and emerging applications. For international readers concerned with the development of the new energy industry, this article provides an authoritative perspective on the overall picture of China’s lithium battery industry.

Definition and Classification of Lithium Battery: Technical Characteristics and Industrial Applications

Lithium battery is a kind of secondary battery using lithium metal or lithium alloy as anode material and non-aqueous electrolyte solution, and its working principle is based on reversible embedding and detaching of lithium ions between positive and negative electrodes. According to the differences in the internal chemical system and physical structure, modern lithium batteries can be divided into several categories, each type has its own advantages in energy density, safety features and application scenarios.

On the core categorization system, lithium batteries can first be divided into primary batteries (lithium primary batteries) and secondary batteries (lithium ion batteries) according to whether they are rechargeable or not. Non-rechargeable lithium primary batteries, such as lithium thionyl chloride batteries, were mainly used in the early days of special medical equipment such as pacemakers, and have become the ideal power source for implantable medical equipment by virtue of their extremely low self-discharge rate (annual self-discharge of less than 1%) and service life of up to 10 years. Rechargeable lithium-ion batteries, on the other hand, constitute the energy core of current consumer electronics, electric vehicles and energy storage systems, and their cycle life is usually between 500-2000 cycles, depending on the specific chemical system and application conditions.

In the field of rechargeable lithium batteries, Chinese industry has established a complete technology matrix:

By cathode material: lithium cobaltate (LiCoO2) batteries dominate high-end consumer electronics, thanks to their excellent volumetric energy density (~600Wh/L) and stable discharge platform (3.7V); ternary nickel-cobalt-manganese (NCM)/nickel-cobalt-aluminum (NCA) batteries become the core of long-range electric vehicles by virtue of their mass of up to 300Wh/kg. Energy density has become the first choice for long range electric vehicles; lithium iron phosphate (LFP) batteries are widely used in electric buses and energy storage systems due to their cycle life of more than 2000 cycles and excellent thermal stability.

By electrolyte form: Liquid lithium-ion batteries are still the mainstream in the market, while soft pack batteries with polymer electrolytes and the emerging all-solid-state batteries represent the direction of technological evolution. As a transitional technology, semi-solid-state batteries have been installed in some high-end electric vehicles in China, and their energy density has increased by about 20% compared with traditional liquid batteries, while significantly reducing the risk of thermal runaway.

According to the shape and structure: cylindrical batteries (such as 18650, 21700, 4680 specifications) are widely used in power tools and some electric vehicles; square aluminum shell batteries occupy the main market share of automotive power batteries by virtue of the advantages of high efficiency of grouping; soft-packed batteries have become the mainstream choice in the field of consumer electronics by virtue of the flexibility of design. choice.

In terms of technological innovation, Chinese enterprises have continued to make breakthroughs in material systems: high-nickel ternary cathode materials (NCM811) have been commercialized and accounted for more than 40% of the market; silicon-carbon anode materials have pushed the energy density up to 400 Wh/kg; lithium-rich manganese-based cathode materials have demonstrated an amazing specific capacity of more than 300 mAh/g, which is regarded as the key material for next-generation high-energy batteries. It is regarded as the key material for the next generation of high-energy batteries. In terms of structural innovation, BYD’s blade battery technology has increased volumetric energy density by 50%, and Ningde Times CTP (Cell to Pack) technology and Kirin battery technology have realized a breakthrough in system-level energy density, supporting electric vehicle range of more than 1,000 kilometers.

With the diversification of application scenarios, the performance boundaries of lithium batteries continue to expand: the ultra-low-temperature lithium batteries developed by the Dalian Institute of Chemical Physics of the Chinese Academy of Sciences, which are still able to maintain more than 80% of their capacity under the extremely cold environment of -36 degrees Celsius, have been successfully applied to polar scientific research and drones in cold regions. And in terms of high temperature stability, through the new electrolyte additives and ceramic diaphragm technology, the power battery has been able to operate safely in a 60 ℃ environment, to meet the Middle East and other high-temperature regions of the application needs.

China has established a complete lithium battery classification system and technology routes, which not only covers the existing market demand, but also lays the foundation for future technology iteration. From smartphones to grid energy storage, from micro-drones to 10,000-ton electric ships, diverse lithium battery technologies are supporting the global competitiveness of China’s new energy industry.

China’s lithium battery technology innovation breakthrough: from material revolution to structural subversion

China’s lithium battery industry has transformed from an early technology follower to a global innovation leader, realizing comprehensive breakthroughs in multiple dimensions such as material system, battery structure and manufacturing process. These technological innovations have not only improved product performance, but also restructured the global competitive landscape of the lithium battery industry, and won the right of technological discourse for Chinese enterprises.

Subversive Innovation in Material System

In the field of anode materials, Chinese research teams have made remarkable progress. A breakthrough study published in Nature magazine by Ningbo Institute of Materials Technology and Engineering, Chinese Academy of Sciences, shows that lithium-rich manganese-based cathode materials produce a unique “shrinkage effect” when subjected to heat, which makes it possible to restore the performance of aging batteries through heat treatment, realizing the “rejuvenation” of the battery. Lithium-rich manganese-based material discharge specific capacity of up to 300mAh/g, far more than the current commercialization of anode materials (lithium iron phosphate about 170mAh/g, ternary materials about 200mAh/g), lithium batteries can be more than 30% increase in energy density. This technological breakthrough solves the problem of “aging” of lithium-rich manganese batteries with voltage degradation in the cycling process, and it is expected to extend the service life of the battery by 2-3 times by regularly “resetting” the structural orderliness of the anode material, providing more durable power support for electric vehicles.

In terms of electrolyte technology, the research and development of solid-state electrolyte has achieved milestones. The ionic conductivity of the oxide-based electrolyte developed by the University of Science and Technology of China has reached the order of 10^-3 S/cm, which is close to the level of liquid electrolyte; the polymer-oxide composite electrolyte developed by NINGDETHEYA has been applied to the first-generation semi-solid-state batteries, and its thermal stability has been improved by more than 200°C compared with that of the traditional liquid electrolyte. The more cutting-edge sulfide solid-state electrolyte has also made laboratory breakthroughs, and is expected to achieve industrialized application around 2027, when the safety hazard of battery combustion and explosion will be completely solved.

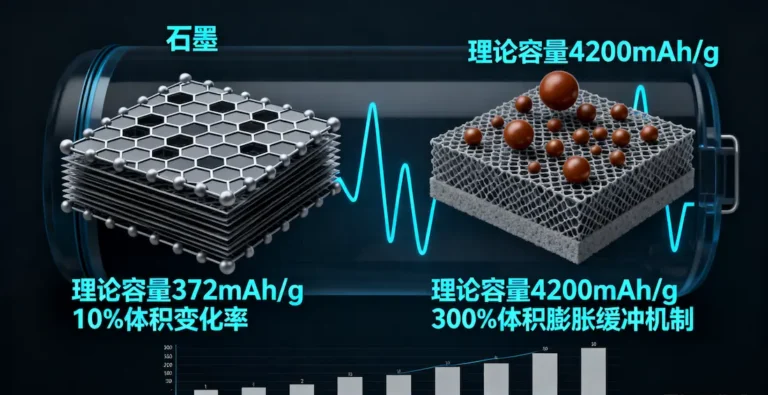

Innovations in negative electrode materials are also notable. The commercial application of silicon-carbon composite anode is gradually maturing, with specific capacity reaching 3-4 times that of graphite anode (1500mAh/g vs. 372mAh/g). The third-generation silicon-carbon anode developed by BYD adopts a porous buffer structure design to control the volume expansion rate within 10%, and its cycle life exceeds the 1,000 times mark. The more revolutionary lithium metal anode has made key technological breakthroughs. Through 3D collector design and artificial SEI membrane construction, the cycle efficiency of lithium metal batteries has been increased to 99.2%, and CIIC expects to launch a lithium metal battery prototype with an energy density of 500Wh/kg in 2026.

Battery Structure and Process Revolution

System structure innovation has become a key path to improve performance. Ningde Times CTP (Cell to Pack) technology skips the module link, increasing volume utilization by more than 20% and reaching a system energy density of 255Wh/kg; BYD’s blade battery adopts a flat design, forming structural support through array arrangement, which not only improves space utilization, but also passes the stringent pinning test. The short blade battery technology developed by Beehive Energy further optimizes production efficiency and grouping flexibility, and is suitable for more vehicle platforms.

In terms of manufacturing process, the dry electrode technology has entered the pilot stage, which can reduce energy consumption by 30% and increase productivity by 25% compared with the traditional wet coating process, and is more suitable for the preparation of solid electrolyte film. The precision of electrode coating has reached ±1μm level, which ensures the consistency and yield of the battery; the laser die-cutting technology controls the burr of the electrode at less than 3μm, which significantly improves the safety performance.

Subversive battery technology research and development

Chinese enterprises have a comprehensive and in-depth layout of new battery systems:

Sodium-ion battery: The first generation of sodium-ion batteries released by Ningde Times in 2023 has a single-unit energy density of 160Wh/kg, maintains more than 90% of its capacity at low temperatures of -20°C, and has a cost 30% lower than that of lithium-ion batteries. The company plans to launch the second generation of products in 2025, energy density increased to 200Wh/kg, and through the lithium-sodium mixed row technology to achieve system-level applications.

Solid-state batteries: Beijing Weilan New Energy has built a semi-solid-state battery mass production line, with an energy density of 360Wh/kg; Qingtao Energy has developed a full-solid-state battery with an oxide electrolyte system, which is expected to be mass-produced in 2026, with an energy density of more than 400Wh/kg. According to forecasts, the market size of China’s solid-state batteries will reach 50 billion yuan by 2030, compared with 50 billion yuan by 2030, with an energy density of more than 400Wh/kg. According to the forecast, China’s solid state battery market size will reach 50 billion yuan in 2030, and energy density will be increased by 40% compared with liquid batteries.

Lithium-sulfur battery: The lithium-sulfur battery developed by Dalian Institute of Chemical Physics, Chinese Academy of Sciences, has exceeded 600Wh/kg energy density, cycle life of more than 500 times, and has shown unique advantages in aviation application scenarios such as drones.

China’s lithium battery technology innovation has formed a gradient layout of “one generation of application, one generation of research and development, one generation of reserves”, and occupies a favorable position in the global battery technology competition. By continuously increasing the basic research and engineering breakthroughs, Chinese enterprises are building technological barriers from material substrate innovation to system integration, providing Chinese solutions for global energy transformation.

Panorama of lithium battery applications: from power revolution to energy transformation

Lithium battery technology in China has formed a diversified, full-scene application pattern, penetrating into various fields of the national economy. As the “heart” of the new energy revolution, lithium batteries are driving profound changes in transportation, energy storage and industrial production methods, and their application boundaries are still expanding.

New Energy Vehicles

China has become the world’s largest new energy vehicle market for nine consecutive years, the penetration rate of new energy vehicles in 2024 exceeded 45%, and it is expected that the domestic sales of electric vehicles in 2025 will reach 15.6 million units, a year-on-year growth of 20%. Behind this amazing growth is the continuous progress and large-scale application of power lithium battery technology. Power battery has become the largest application field of lithium battery, with shipments expected to exceed 820GWh in 2024, accounting for more than 75% of China’s total lithium battery output.

Diversified trends in the choice of technology routes: high-end models generally use high-nickel ternary batteries, energy density of 300Wh/kg or more, to support 600-1000 kilometers range; mid-range models tend to lithium iron system, with the cost and safety advantages to occupy the mainstream; and the emerging programmable electric vehicles have begun to use the power of lithium-ion batteries, to meet the fast charge and discharge Demand. As the global power battery leader, Ningde Times will have a 36.8% global market share in 2024, and its innovative Kirin battery adopts the third-generation CTP technology, with a system energy density of 255Wh/kg, which has been applied in high-end models of Tesla and BMW.

In terms of international layout, China’s power battery enterprises have accelerated globalization, with the capacity of Ningde Times’ German plant reaching 14GWh, Guoxuan Hi-Tech’s U.S. base going into operation in 2025, and BYD setting up overseas production bases in Thailand, Brazil and other places. According to SNE Research data, in the first ten months of 2024, Chinese enterprises occupied six seats in the top ten enterprises in the global power battery installed capacity, with an overall market share of more than 65%, while the share of Japanese and Korean enterprises continued to decline. This dominant market position stems from the overall competitiveness of Chinese companies in technology, cost and supply chain.

Large-scale energy storage system

As the proportion of renewable energy increases, lithium batteries for energy storage will see explosive growth. 206GWh of lithium batteries for energy storage will be shipped from China in 2023, up 58% year-on-year, accounting for 85% of the global total. It is expected that in 2025 the global demand for new installed capacity of energy storage will reach 220-250GWh, of which China accounts for 120GWh, the U.S. 55-70GWh, and large-scale projects in the Middle East will also bring dozens of GWh demand.

The application of technology presents two major directions: grid-side energy storage mainly uses lithium iron phosphate batteries with a cycle life of more than 8,000 times, and the system cost has been reduced to less than $0.8/Wh; user-side energy storage tends to be intelligent, with integrated energy management, peak/valley arbitrage, and emergency power supply functions. The 2MWh energy storage system launched by Huawei Digital Energy adopts an intelligent string design, with a cycle efficiency of more than 92%; and the liquid-cooled energy storage system developed by Sunny Power realizes higher energy density and uniform temperature.

Emerging application scenarios continue to emerge: the GWh energy storage project developed by Ningde Times in cooperation with the State Grid has effectively alleviated the peak pressure on the regional power grid; the containerized energy storage system developed by BYD has been exported to more than 80 countries and regions. More cutting-edge “light storage and charging” integration mode in many pilot, building a distributed energy network. It is predicted that by 2030, the global fixed energy storage market will exceed 2,000GWh, and China is expected to occupy more than 60% of the market share.

Consumer Electronics and Emerging Fields

Despite the rapid growth of power and energy storage batteries, consumer lithium batteries are still growing steadily, and shipments are expected to exceed 50GWh in 2024. application scenarios have expanded from smartphones and laptops to emerging fields such as AR/VR devices, drones, and power tools, which have put forward higher requirements for battery energy density and fast-charging performance.

High-end consumer electronics generally use high-voltage lithium cobalt-acid batteries, the operating voltage from 4.35V to 4.4V or even 4.45V, volumetric energy density of 700Wh/L or more; silicon negative electrode in the TWS headset batteries began to be applied to enhance the capacity of more than 20%. The ultra-thin battery developed by Zhuhai Guanyu has a thickness of only 0.45mm, which is used in foldable devices; the high-multiplier battery launched by YWL supports 5C continuous discharge to meet the needs of high-end drones.

Emerging application fields show great potential: low altitude economy generates demand for high specific energy batteries, electric vertical take-off and landing vehicle (eVTOL) needs more than 400Wh/kg battery system; medical electronic equipment on the safety and reliability of the battery requires stringent requirements; IoT node equipment needs ultra-low power consumption and long life power supply. In addition, the military field, such as man-portable equipment, underwater equipment and other special applications, also promote the development of lithium battery technology to extreme conditions of adaptability.

Table: Comparison of technical parameters of main applications of lithium batteries

| Areas of application | Mainstream technology routes | Energy density (Wh/kg) | Cycle life (times) | Cost trends |

|---|---|---|---|---|

| electric vehicle | Ternary/Lithium Iron Battery | 180-300 | 1000-4000 | 5-8% per annum |

| energy storage system | lithium iron phosphate battery | 120-180 | 4000-8000 | 10% average annual reduction |

| consumer electronics | Lithium Cobaltate/Polymer | 250-700(Wh/L) | 500-1000 | basic stability |

| aerospace industry | High nickel ternary / lithium sulfur | 300-600 | 200-500 | high |

The diversified development of lithium battery applications in China has built up a three-pronged pattern of “power + energy storage + consumption”, which has strengthened the industry’s ability to resist risks. As technology continues to advance, lithium batteries are penetrating into more emerging fields, providing key support for the global energy transition and carbon neutrality. From the ground to the sky, from the home to the power grid, lithium battery technology is reshaping the way and efficiency of human energy utilization.

Global Competitive Landscape of China’s Lithium Battery Industry: From Market Dominance to Technology Leadership

China’s lithium battery industry has established a complete industrial chain from upstream resources to downstream applications, and has occupied a dominant position in the global market. With continuous technological innovation and production capacity expansion, Chinese enterprises are shifting from scale dominance to technological leadership, restructuring the pattern of the global power battery industry.

Market Concentration and Leading Enterprises

China’s power battery industry shows a highly concentrated competitive pattern, with an increasingly significant head effect. 2024 CR3 (Ningde Times, BYD, China Innovation Hangzhou) market share reached 75%, up 15 percentage points from 2020; CR10 is as high as 95.6%, covering almost all the effective capacity. Ningde era with 45.1% of the domestic market share and 36.8% of the global share of the first stable, seven years in a row in the global power battery installed capacity of the first list, its technology route and production capacity planning has become the industry wind vane.

Leading enterprises build a moat through technological innovation: Ningde Times has a national engineering research center for electrochemical energy storage technology, and the R&D expense rate continues to remain above 6%, with the global installed volume reaching 252.8GWh in the first half of 2024, a year-on-year growth of 28.3%; BYD, with its advantage of vertical integration, has laid out the layout of batteries and vehicle manufacturing at the same time, with the installed volume of power batteries increasing by 31% year-on-year in 2024. Power battery installed capacity increased by 31.3% year-on-year, its “blade battery” technology set up a safety benchmark through the pinprick test; in the new aviation is focused on the development of high-voltage ternary batteries, energy density is at the industry’s leading level, the global market share increased to 5.2%.

Echelon differentiation is obvious: the second echelon of Guoxuan Gaoke, Yiwei Lithium Energy, Beehive Energy and other enterprises with market share between 2% and 10%, seeking breakthrough through differentiated technology routes. Guoxuan Gaoke is deeply engaged in lithium iron system, with a single energy density of 210Wh/kg; LiWei Lithium layout of large cylindrical batteries, suitable for high-end electric vehicles; Beehive Energy launched the short blade battery to achieve a balance between cost and performance. The third echelon enterprises are mainly focusing on market segments or specific technology routes, such as the soft pack ternary batteries of Vonergy Technology, DuoFuDuo’s lithium hexafluorophosphate electrolyte materials, and so on.

Industry chain synergy and globalization layout

In terms of upstream resource control, Chinese enterprises safeguard supply chain security through overseas mergers and acquisitions and strategic cooperation. Tianqi Lithium and Ganfeng Lithium control 75% of the global cobalt refining and 60% of the lithium processing capacity, and have established stable supply channels in resource countries such as Australia, Chile and Argentina. The integrated industrial chain of nickel and cobalt resources, precursors and anode materials created by Huayou Cobalt has significantly improved resource utilization efficiency and cost competitiveness.

Manufacturing links form cluster advantages: China occupies 75% of the global power battery production capacity, amounting to 1.8TWh in 2024, and key parameters such as electrode coating precision and drying process are ahead of international counterparts. The Yangtze River Delta, Pearl River Delta and Chengdu-Chongqing region have formed three major lithium battery industry clusters, covering the whole industry chain from materials to battery cores. Ningde Times Fuding Base has a capacity of 100GWh, the largest single battery factory in the world; BYD’s “blade battery” production bases in Chongqing and Changsha have a capacity of over 20GWh each.

Accelerated globalization layout: in the face of the European and American market localization policy requirements, Chinese enterprises to change the export mode to localized production. Ningde Times German factory supplies BMW and Volkswagen, and plans to build a factory in North America; YWL signed a land purchase agreement with the Hungarian city government of Debrecen to build a large cylindrical battery factory; Guoxuan Gaoke invested 2.36 billion U.S. dollars in Michigan to build a cathode material factory and a battery Pack base. This globalized production capacity layout effectively avoids trade barriers and strengthens supply chain resilience.

Technical Standards and Policy Leadership

China is changing from a lithium battery manufacturing center to a standard setter. The National Electric Energy Storage Standard Committee has formulated a series of standards such as “Lithium-ion Battery for Electric Energy Storage”, which has been adopted by IEC as an international standard; and the power battery safety standard developed by Ningde Times has become an important reference for the United Nations’ Global Technical Regulations for Electric Vehicles (GTR). In terms of battery carbon footprint, China has established a database covering the whole life cycle from raw materials to recycling, forcing enterprises to use green power for production, and the proportion of green power used by head enterprises will exceed 40% in 2024.

The policy system is constantly improving: the “New Energy Vehicle Industry Development Plan (2021-2035)” specifies the power battery energy density target of 400Wh/kg, and the cycle life of more than 2,000 times; the “Specification Conditions for Lithium-ion Battery Industry” strengthens the safety and quality management requirements. Nine departments jointly issued “on accelerating the enhancement of new energy vehicles power lithium battery transportation services and safety and security capacity of a number of measures”, systematic planning of power lithium battery transportation services and safety and security system, put forward by 2027 to significantly improve the level of transportation safety and security goals.

The layout of intellectual property rights is remarkable: according to the Patent Classification System for the “New Three Kinds” related technologies, the number of Chinese patents in the field of lithium batteries accounts for more than 40% of the world’s patents, with obvious advantages in the core technology fields of cathode materials, electrolytes and battery modules. Ningde Times has applied for more than 16,000 patents globally and authorized more than 5,000 patents; BYD’s blade battery patents have completed their layout in major global markets. This intellectual property advantage provides strong support for Chinese enterprises to participate in international competition.

China’s lithium battery industry has formed a positive cycle of “technological innovation-capacity expansion-market application”, building up a comprehensive competitiveness that is difficult to replicate. From the control of raw materials to end products, from manufacturing process to application standards, Chinese enterprises are holding stronger and stronger voice in the global lithium battery industry, and this advantage is expected to be further expanded in the next generation of battery technology revolution.

Future Outlook: Technology Trends and Challenges in China’s Lithium Battery Industry

China’s lithium battery industry is standing at a new historical node, facing huge opportunities brought by the energy transition and carbon neutrality targets, and at the same time need to cope with multiple challenges such as technology iteration, resource constraints and international competition. The next five to ten years will be a critical period of industrial development, and technological innovation will continue to be the core driving force to promote lithium batteries to higher energy density, lower cost, safer, more reliable and more sustainable direction.

Key Technology Development Trends

The commercialization of solid-state battery technology is accelerating. The polymer electrolyte solid-state battery developed by Qingdao Institute of Bioenergy and Process Research of Chinese Academy of Sciences has passed the pinning test, and is expected to be mass-produced in 2026; Ganfeng Lithium has built a semi-solid-state battery production line with a capacity of 10GWh, supporting high-end electric vehicles. All-solid-state batteries still face interface impedance and cost challenges, but laboratory research continues to make breakthroughs, sulfide electrolyte system in ionic conductivity and interface stability progress is particularly exciting. The industry predicts that by 2030 solid-state batteries will dominate the high-end market, and energy density is expected to exceed 500Wh/kg, completely solving the safety problem.

Material innovation continues to deepen. Lithium-rich manganese-based cathode materials are expected to become the first choice for next-generation high-energy batteries after solving the voltage decay problem, and the energy density of more than 400Wh/kg can be realized with lithium metal anode. In terms of anode, the pre-lithiation technology and expansion buffer structure of silicon-based anode are continuously optimized, and the mass production cost is expected to be reduced by 30%; the successful application of hard carbon materials in sodium-ion batteries also provides new ideas for lithium anode. In the field of electrolyte, the localization of new lithium salt LiFSI will improve the high-temperature performance of high-nickel batteries, while ionic liquid additives enhance the stability of high-voltage batteries.

Structural innovation and system integration move to a higher level. The CTC (Cell to Chassis) technology being developed by Ningde Times will directly integrate the battery into the chassis of the vehicle, increasing the space utilization rate by more than 30%, and is scheduled to be mass-produced in 2026; and the Dragon Scale battery developed by Beehive Energy adopts a double-side cooling design, which will increase the heat dissipation efficiency by 50%. In the manufacturing process, the scale application of dry electrode technology will significantly reduce production costs and energy consumption, while 3D printing battery technology may subvert the traditional manufacturing model, to achieve the precise construction of complex structure electrode.

Alternative technologies such as sodium-ion batteries will ease the pressure on lithium resources. The second-generation sodium-ion battery developed by Ningde Times has an energy density of 200Wh/kg and a cost 30% lower than that of lithium-ion battery, which has a broad prospect in the field of energy storage and low-speed electric vehicles. The 10GWh sodium-ion battery production line constructed by Zhongke Haijia has been put into production, and its products perform well in electric two-wheeled vehicles and energy storage power stations. Lead-carbon batteries and liquid-flow batteries will also complement lithium batteries to build a diversified energy storage technology system.

Sustainable development and circular economy

Resource security faces serious challenges. Global lithium resources are unevenly distributed, and China’s dependence on external lithium resources exceeds 70%. In order to ensure supply chain security, Chinese enterprises have accelerated their global layout: Ningde Times invested in the construction of Bolivia’s lithium salt lake project with an annual output of 100,000 tons of lithium carbonate; BYD has obtained a lithium mining quota in Chile; and Tianqi Lithium’s holding of the Greenbush mine is the world’s largest hard-rock lithium mine. At the same time, deep-sea cobalt-rich crusts, geothermal brines and other unconventional resources exploration is also advancing, is expected to open up new resource channels.

Recycling system is gradually improved. Policy requirements to 2025 battery recycling utilization rate of 98%, giving rise to green beauty, Bonpublic circulation and other multi-billion recycling enterprises. The “directional recycling” technology developed by Bump Circulation makes the recovery rate of nickel-cobalt-manganese reach 99.3%, and the recovery rate of lithium carbonate exceeds 90%; the “battery full life cycle value chain” model established by Grimmie covers the whole process from recycling to material recycling. In the future, with the surge of retired batteries (expected to exceed 1.2 million tons in 2030), the recycling industry will usher in explosive growth, forming a closed-loop ecology of “production-use-recycling-regeneration”.

Carbon footprint management has become a new focus. EU battery regulations require the disclosure of the whole life cycle carbon emissions, forcing Chinese enterprises to build a green supply chain. Ningde Times Sichuan plant realizes 100% green power production, and the carbon footprint of battery products has been reduced to less than 50kgCO2/kWh; Vision Power’s zero-carbon battery plant in Ordos realizes net-zero emissions through the integration of wind power and storage. This kind of low-carbon transformation is not only a necessary move to cope with international regulations, but also a strategic choice to enhance the competitiveness of the industry.

Challenges and Strategies

Technical bottlenecks still need to be broken through. Despite the high capacity of lithium-rich manganese-based cathode materials, voltage degradation and cycling stability issues still need to be resolved; the interfacial impedance and multiplicity performance of solid-state batteries limit their commercialization. China needs to strengthen its investment in basic research, establish a collaborative innovation system of “industry-university-research-utilization”, and make breakthroughs in materials, interfaces, processes and other underlying technologies. The state should support the construction of a number of national battery innovation centers, focusing on cutting-edge technology research and development and engineering verification.

International competition is becoming increasingly fierce. Europe and the United States through the Inflation Reduction Act and other policies to attract the battery industry chain back, South Korea’s three major battery manufacturers, although the share of decline, but still hold the core technology. Chinese enterprises need to speed up the international layout, set up R & D centers and production bases in Europe and the United States, and actively participate in the development of international standards, and strive for the right to speak technology. Strengthen the protection of intellectual property rights, to avoid technical friction, is also the key to deal with international competition.

Cost pressure should not be ignored. Although the cost of lithium batteries continues to decline (graphite anode prices fell about 15% in the past five years), lithium price fluctuations and dependence on imports of high-end materials are still affecting the stability of the industry. Through the scale effect, process optimization and material innovation, the cost of power battery is expected to drop to below 70/kWh by 2030, and energy storage battery to below 50/kWh, which will truly achieve parity with fossil energy.

China’s lithium battery industry is in a critical period from quantitative change to qualitative change, technological innovation will shift from progressive improvement to disruptive breakthroughs. Led by the “double carbon” goal, lithium batteries will continue to serve as the core carrier of the new energy revolution, promoting the electrification of transportation and energy clean-up process. In the face of the future, China’s lithium battery industry needs to adhere to the development path of innovation-driven, open and cooperative, consolidate the existing advantages, break through the technical bottlenecks, build a safe, efficient and sustainable industrial ecology, and contribute to the global energy transition with Chinese wisdom and Chinese solutions.

2 Comments