Dazhong mining 1 billion bet on lithium metal materials, solid-state battery industrialization to add a key piece of the puzzle

A piece of silver-white lithium metal, is becoming the core pivot to pry hundreds of billions of solid-state battery market. Linwu County, under the mines, a material revolution quietly opened.

June 18, Dazhong Mining announced an investment of 1 billion yuan in Hunan Linwu County to build an annual output of 3,000 tons of lithium metal battery new materials project, promoted in three phases: 2025 to complete the R & D and small pilot test, the end of 2027 to achieve the first phase of 1,000 tons of production capacity in 2028 to complete the full commissioning of the plan.

This marks the first time that lithium metal – the core material of solid-state battery anode – has gained a 10,000-ton capacity layout in China. Relying on the 3.24 million tons of lithium carbonate equivalent resources controlled by Dazhong Mining in the region, the project will build a closed loop of the whole industrial chain from lithium mining to high-end anode materials.

1 . Industry positioning war: lithium metal as the key to solid-state battery breakout

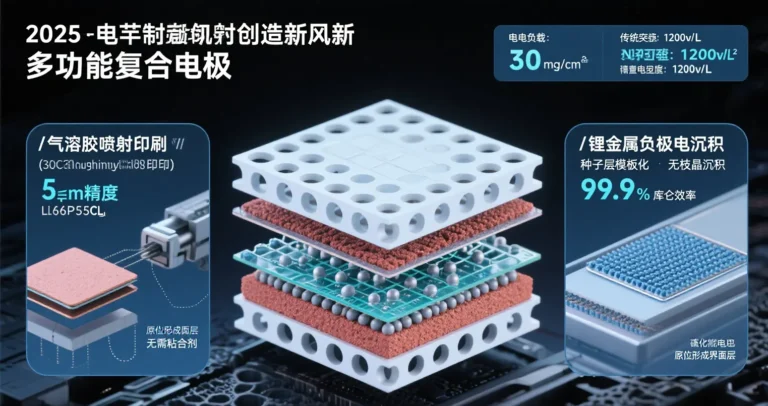

The commercialization of all-solid-state batteries has entered the materials stage. Industry reports show that lithium metal anode has become the core material for realizing energy density above 400Wh/kg with a theoretical specific capacity of 3860mAh/g, which is more than 10 times that of graphite anode (372mAh/g).

However, its industrialization has long been subject to two major bottlenecks: one is the high price of lithium metal, the market price in 2025 still reaches 8 million yuan / ton; the second is the thin lithium belt processing technology difficulties, the traditional process is difficult to stabilize the production of ultra-thin lithium belt below 20μm.

Dazhong Mining’s strategic layout directly hit the pain points:

(1) Relying on its own lithium resources, the cost of raw materials is reduced by more than 30%.

(2) Adopting vapor deposition technology, aiming to reduce the thickness of lithium tape from the mainstream 15-20μm to 2-3μm.

(3) planning for 2030 will be compressed to 1 million yuan / ton of lithium metal material costs

This cost reduction path coincides with the tipping point of industry outbreak. According to the Polybillion Information Consulting forecast, the global demand for solid-state batteries will exceed 44.2GWh in 2025, and the market size in 2030 will reach hundreds of billions of dollars.

2. Race for mass production: sulfide route leads the industrialization process

In the technical route division, sulfide electrolyte system is becoming an industrial consensus with overwhelming advantages. Ningde Times, BYD, Vonergy and other head enterprises collectively choose the combination of “sulfide electrolyte + lithium metal anode” to promote the energy density to 500Wh/kg breakthrough.

2025 becomes the key node of mass production:

VuNeng Technology 60Ah sulfide all-solid-state battery will be delivered in small batch at the end of the year, the energy density of 400-500Wh/kg

Guoxuan Gaoke completed 0.2GWh pilot line, battery yield exceeded 90%

Toyota and Idemitsu announced that in 2027-2028 to realize the all-solid-state battery loaded with cars

Policy dividends to accelerate the pace of industrialization. China’s ministry of industry and information technology has invested 6 billion yuan in special research and development funds, and will set the end of 2025 as the mid-term review node of sulfide batteries, and aims to realize 1,000-vehicle demonstration operation in 2027.

3 . Encapsulation revolution: soft pack technology to open the performance ceiling

When the material system continues to break through, encapsulation technology has become a key valve to release performance. Lithium shield new energy technology director Zhang Jiebing pointed out: aluminum-plastic film stress buffer characteristics, can effectively prevent the solid-state electrolyte interface cracking”.

Soft pack encapsulation in the field of solid-state batteries show unique advantages: equipment investment costs than hard shell batteries reduced by 40%; with lithium metal anode, monomer energy density of up to 500Wh/kg; thermal runaway critical temperature increased to more than 300 ℃

This technology path has been market proven. Aviation batteries developed by Voron Technology based on the soft pack platform have passed the FAA certification, and realized “no smoke, no fire, no explosion” in the 100% full-charge pin-prick test, with a cycle life of more than 10,000 times.

4. Equipment first: hundreds of billions of dollars in the market to generate a new manufacturing ecology

The industrialization of solid-state batteries is reshaping the pattern of the equipment market. Soochow Securities research report pointed out: “2025-2026 pilot line intensive landing period, the equipment link will usher in a continuous iterative optimization”.

Manufacturing changes focused on the front and middle processes:

dry electrode equipment: binder fiberization technology to solve the traditional wet solvent sensitivity

isostatic pressure equipment: 600MPa high-pressure molding to solve the solid-solid interface contact problems

high-precision stacking machine: precision of ± 1μm, suitable for multi-layer stacking of soft pack batteries

equipment market is about to usher in explosive growth. By 2030, the global solid-state battery equipment market size is expected to reach 14 billion yuan, of which isostatic pressure equipment, dry film forming equipment, high-precision stacking machine has become the three core increment.

Solid-state battery battlefield has shifted from the laboratory to the supply chain: Toyota and Idemitsu joint research on sulfide electrolyte mass production process; lithium shield new energy to accelerate the construction of an annual output of 40 million square meters of aluminum-plastic film production line dedicated to solid-state batteries; Foster lithium soft packaged aluminum-plastic composite film, for solid-state & power & energy storage & 3C flexible packaging batteries to provide new solutions!

Dazhong Mining’s lithium metal project site is adjacent to BYD’s Hunan production base.

When the three forces of material, process and equipment meet in Linwu County, China’s solid-state battery industry is weaving a complete industrial chain from mine to end product. The strength of this chain will determine who can be the first to pick the new energy crown on the pearl.