Solid-state battery mass production countdown! 2026 Xinwangda solid-state battery mass production countdown

Engineers strike hard from the outset

“When CATL said ‘interface impedance remains unsolved,’ Toyota pushed mass production back to 2030, but Xinwangda’s solid-state battery mass production date is set in stone for 2026! This isn’t just talk: 320Wh/kg batteries are already installed in drones, 360Wh/kg samples have passed military-grade needle penetration tests, and they’ve even said they’ll bring the cost per kilowatt-hour down to under 2 yuan—if that happens, 700-kilometer electric vehicles will enter the 150,000 yuan price range, and the coffin nail for gasoline vehicles will be firmly hammered in.”

1. Technical Approach: Bypassing the Deadly Trap of Semi-Solid-State Batteries

Disruptive Safety Parameters:

▶ Needle penetration test temperature increase of only 1.8°C (traditional ternary batteries catch fire) 1

▶ Passed 200°C thermal box test: electrolyte reduced to zero, completely eliminating the risk of combustion or explosion.

Extreme environment adaptation:

| energy density | Operating temperature range | application scenarios |

|---|---|---|

| 320Wh/kg | -30°C~60°C | Two-wheeled vehicles/energy storage |

| 360Wh/kg | -35°C~80°C | UAV/satellite military industry |

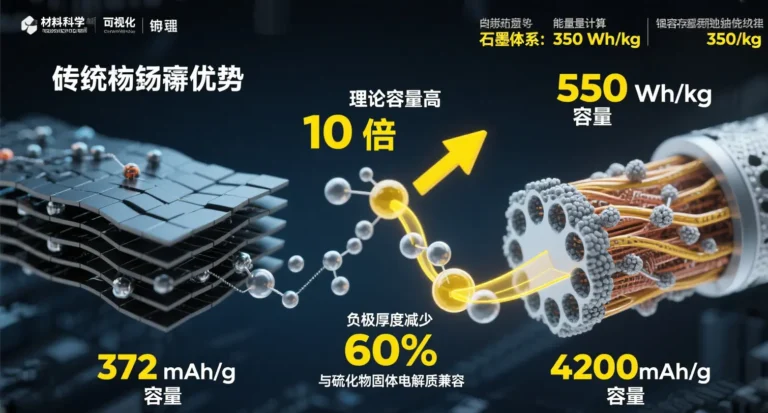

Laboratory nuclear weapons: 500Wh/kg samples use lithium metal anodes + sulfide electrolytes, paving the way for the second generation in 2027.

Engineers’ harsh comments: “Semi-solid is a compromise transition product! Sunwoda dares to jump to all-solid sulfide because it holds 217 patents and a 100,000-ton electrolyte price lock agreement—this is true all-in.”

II. Mass Production Ace: Cost Reduction of Dry Electrode Process

Material Revolution:

Cathode: Lithium-rich manganese-based material → Zero nickel and cobalt, 30% cost reduction

Anode: Lithium foil vs. silicon-carbon → 45% cheaper

Electrolyte: Sulfide composite ceramic → Raw material cost reduced by 80%

Process Disruption:

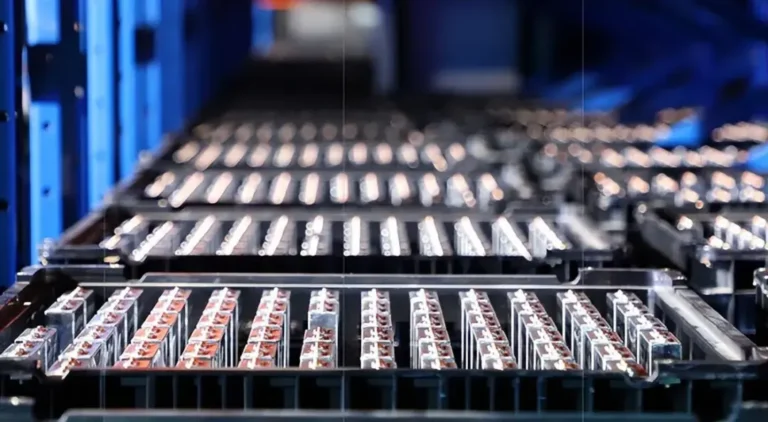

▶ Huizhou base’s 10GWh dedicated production line adopts dry electrode process

▶ Eliminates solvent coating → production efficiency ×31

▶ Compared to wet process, energy consumption reduced by 60%

Supply Chain Control:

Yunnan Zhongsheng secures 100,000 tons of sulfide at 110,000 yuan/ton (market price over 180,000 yuan)

Electrolyte cost ratio reduced to 17% (traditional batteries >30%)

Procurement calculations: If the 2 yuan/Wh target is achieved, the cost of a 60kWh battery pack would be only 120,000 yuan → the price of an electric vehicle with a 700km range could break 150,000 yuan!

III. Application verification: A game-changing disruption from space to the ground

| field | progress | Business value points |

|---|---|---|

| military and aerospace | Satellite vibration test energy stable release | Join the Starlink waiting list |

| low-altitude economy | 100-kilogram-class drone payload flight | At -20°C, battery life only decreases by 7%. |

| electric vehicle | Dongfeng Motor 350Wh/kg sample testing | For use in high-end sub-brands in 2026 |

| two-wheeled vehicle | Supply of 200MWh pilot line | Low-temperature market crushes competitors |

Engineers warn: “The 360Wh/kg battery with a 10C discharge rate is a goldmine for electric tool manufacturers, but production capacity will only reach 1GWh by 2026—those aiming to secure the first batch of quotas should act now!”

IV.A Life-or-Death Gamble: The Comeback and Risks of Second-Tier Manufacturers

Technical Gamble on Capital:

▶ R&D team of 1,200 people (doubled in two years)

▶ 3.86 billion yuan in R&D spending on solid-state batteries (65% of total)

▶ 687 global patents (42% PCT international patents)

Financial Cliffhanger:

Power battery business loses 144 million annually, with a net profit margin of just 3.14%

Hong Kong IPO looms: 35.5 billion subsidiary valuation to prop up the parent company

Industry Rivalry: CATL aggressively pursues solid-state polymer technology, while Toyota sticks to the sulfide route—if Xinwangda’s mass production fails to materialize, it risks being squeezed out by industry giants’ technological advancements

V.Procurement Action Guide

Secure Capacity: With only 1 GWh of capacity by 2026, prioritizing contracts can secure price protection clauses

Verify Technology: Require third-party needle penetration test reports (temperature rise <2°C to meet standards)

Prevent Delays: Include production delay compensation clauses in contracts (refer to CATL’s solid-state battery delay case)

Target Scenarios: Drone/military orders can secure priority sample supply rights

Engineer’s Conclusion: “If Xinwangda succeeds, we will witness second-tier manufacturers using technology to break the giants’ monopoly; if it fails, it will serve as a warning to the entire industry: solid-state battery mass production is a hellish challenge requiring capital, technology, and supply chain integration. Regardless, 2026 will be the D-Day of the battery revolution.”