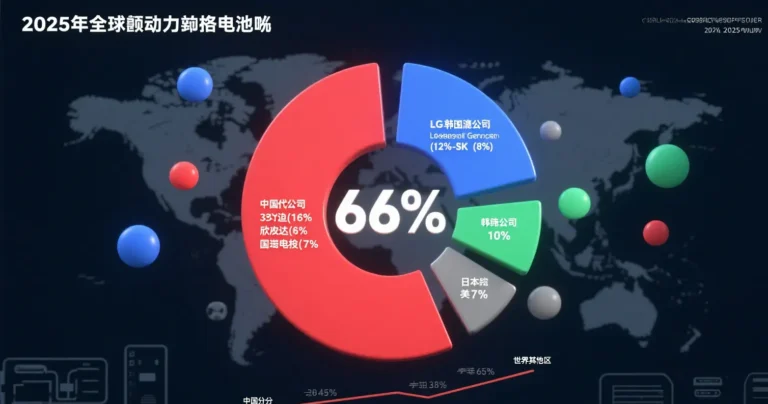

The Global Automotive Battery Landscape Will Undergo Dramatic Changes by 2025

▍Market Dominance: Three Engines Account for Nearly 70% of the Market Share, Dominated by Six Chinese Companies

Absolute Technological Leadership

Lithium Iron Phosphate (LFP) Route: Chinese manufacturers dominate the global LFP battery market, accounting for 81.5% of global installations. LFP batteries have a cost per kilowatt-hour that is $15-20 lower than ternary batteries, and through CTP technology, they achieve a range of over 700 km, completely redefining the high-end vehicle market landscape.

Honeycomb Energy Short-Blade Batteries: With a year-on-year growth rate of 110.1% (10.5 GWh installed in the first five months), it has become the fastest-growing manufacturer. Its modular design is compatible with European models such as the BMW MINI, with overseas shipment volume increasing to 38%.

European localization blitz

CATL’s German factory has ramped up production capacity to 44 GWh/year, driving its European market share to 44% (with Volkswagen/Audi/BMW contributing 41% of orders).

Guoxuan High-Tech’s Slovakia base (20 GWh/year) is expected to begin production in 2026, directly circumventing the EU’s new carbon footprint regulations on imported batteries.

Policy Risk Mitigation Capabilities

Following the repeal of the U.S. Inflation Reduction Act (IRA), LG Energy Solution reduced its capital expenditures by 30%, while Chinese companies accelerated their布局 in Southeast Asia:

CATL’s Indonesia project: A $6 billion investment to integrate nickel ore resources and achieve end-to-end integrated production.

EVE Energy’s Malaysia base: An 8.65 billion yuan investment in energy storage batteries to target the ASEAN household energy market.

▍The Truth Behind Japan and South Korea’s Collapse: Misjudgment of Technological Pathways and Geopolitical Backlash

| dimension | Advantages of Chinese enterprises | The predicament of Japanese and South Korean companies |

|---|---|---|

| technology iteration | Breakthrough in LFP low-temperature performance (75% capacity retention at -30°C) | High-nickel ternary R&D lags behind, Panasonic’s market share drops to 2.9% |

| Cost control | Large-scale production reduces pack costs by 18% | Labor costs at US factories are three times higher than in China. |

| Customer stickiness | Binding Xiaomi/Tesla and other new growth markets | Over-reliance on Tesla (70% of LG New Energy’s revenue) |

Key turning point: European automakers shift their battery procurement to China, causing South Korean manufacturers’ market share to plummet by 15.4 percentage points to 35.6%.

▍Must-read for buyers: Three major trends to watch out for in the second half of 2025

LFP production capacity competition

CATL’s LFP production capacity is scheduled until 2026, while second-tier manufacturer Hive Energy has shortened its delivery cycle to 45 days. We recommend that buyers lock in long-term contracts in advance.

Southeast Asia Supply Chain Advantages

Indonesia/Malaysia offers a 10-year corporate income tax exemption. Chinese manufacturers are building a complete ecosystem from mines to battery cells, with localized procurement reducing costs by 23%.

EU Carbon Barrier Response

The Battery Passport requirement, which will be enforced in 2026, mandates disclosure of full lifecycle data. Only leading companies like CATL and BYD have obtained certification.