2025 first half of new energy vehicle enterprises battery supporting panorama: ningde times dominate the list, car enterprises self-research wave

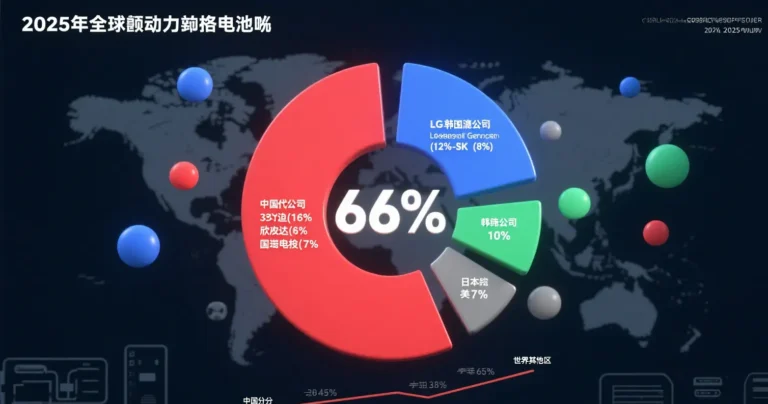

Power battery supporting pattern is being reconstructed with the fierce battle in new energy market. from January to March 2025, the global power battery installed capacity reached 221.8GWh (38.8% year-on-year), and Chinese battery enterprises occupied six seats in the top ten, with a combined market share as high as 67.5%. This article will deeply analyze the battery supporting supply chain strategy of mainstream new energy vehicle enterprises, and reveal the new trend of technology routes and competition.

⚡️ 01 Analysis of Battery Supply Chain Strategies of Leading Automobile Enterprises

BYD: Vertically integrated moat

All models are exclusively supported by its FDD battery, with a domestic installed volume of 30.87GWh from January to March 2025 (market share of 23.79%). Relying on the self-supply system, BYD in the cost and supply chain stability to establish an advantage, January to May to drive the battery installed capacity of more than 48GWh, the expansion of the overseas market to accelerate its 5.5 million annual sales target reached.

Hongmeng Zhixing: the technology benchmark of Ning Wang’s deep binding

The “Four Worlds” models, such as the Ask World and the Smart World, are 100% supplied solely by Ningde Times. Taking M9 as an example, it is equipped with Ningde Times CTP2.0 battery pack, with an energy density of 166Wh/kg, integrated with five-layer electric core safety wrapping and ten-layer thermal runaway protection technology, predicting hidden dangers and supporting millisecond-level power outage through AI. 10GWh of batteries were installed from January to May, which confirms that the high-end market is relying on NINGWANG’s technology.

Geely: diversified supply + self-research breakout

Supplier covers more than 10 enterprises such as Ningde Times, Hive Energy, Xin Wangda, etc., battery installed over 18GWh in Jan-May.10 In order to strengthen control, Geely set up Zhejiang Jiyao Passage Energy Technology, integrating the battery business and planning to build its own production capacity of 70GWh in 2027, pointing to the autonomy of the supply chain.

Zero run and peng: the second line battery factory opportunity land

Zero Run Auto: Guoxuan Gaoke, Zhengli Xinneng, and Zhongxin Innovation Voyage are the main suppliers. Its explosive model C10 is equipped with a new generation of BEV batteries from Zhengli Xinneng, supporting 800V high-voltage fast charging, and driving the installed base of more than 8GWh from January to May.

Xiaopeng Automobile: Yilv lithium-ion energy, Fudi batteries, and Zhongxin Innovation Airline have multiple lines in parallel. Lithium-Weft accumulative supporting more than 150,000 vehicles, covering the G3 to X9 full range of models; Peng G7 listing will further boost the demand for high-voltage batteries.

🔬 02 technology route: lithium iron phosphate dominated, high-voltage fast charging into the standard

The victory of cost and safety: lithium iron phosphate market share of 79.3%

In the first batch of new car announcements in 2025, lithium iron phosphate batteries accounted for 79.3% of passenger cars (27.5 percentage points higher than in 2024).10 Products such as BYD’s second-generation blade batteries and Ningde Times’ Shenxing batteries, through monocrystalline cathode and structural innovations, have increased the energy density of the pack to 200Wh/kg, supporting a range of 700km+, completely breaking the “Lithium iron = low-end” stereotype.

Great leap forward in plug-in hybrid battery carrying capacity

The battery packs of plug-in hybrid models such as M8 and Link 900 exceeded 50kWh, and the off-road-specific battery pack of Hive Energy for Tank 500Hi4-Z reached 59kWh.10 The large power design has made the pure electric range of plug-in hybrid models close to 200km, which has become the main force of market growth (the growth rate of plug-in hybrid sales of many automobile enterprises in the first half of the year exceeded 100%).

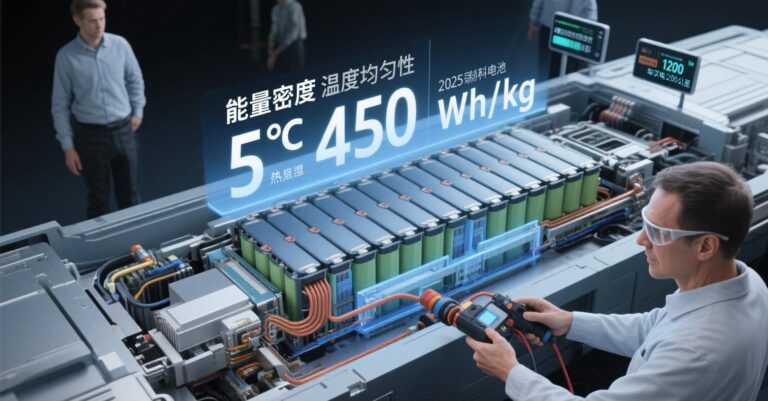

Popularization of 800V high-voltage platform

Xiaopeng P7+, Krypton 007 and other models are fully equipped with 800V high-voltage battery system, realizing “charging for 5 minutes, range of 200km”. Lithium-ion, Ningde Times and other companies have introduced low internal resistance battery cell + multi-pole ear design to solve the problem of fast charging temperature rise, and the technology has become the standard for models above 200,000 yuan.

🏭 03 New forces in the supply chain: the rise of self-developed batteries by car companies

Traditional automobile enterprises: get rid of “Ningwang dependency syndrome”.

GAC EAN: self-built surging battery and giant bay technology research, while external procurement of ningde era, yiwei lithium energy, 1-5 months installed 5.34GWh.

Chery and Geely: its get one energy, extreme electric new energy and other “full-fledged” battery companies into the installed list, although the current scale is small, but for the long-term to pave the way to external dependence.

New forces: binding second-tier manufacturers to reduce costs

Ideal car using Xinda, honeycomb energy to replace part of the share of Ning Wang; deep blue car by the innovative aviation main supply. Second-line battery manufacturers open the market with customized PHEV/extended-range special batteries, such as Beehive Energy 59kWh off-road battery packs, which meet the demand of complex working conditions by strengthening structural protection.

🚀 04 Next-generation batteries: accelerated industrialization of solid-state batteries

2025: the first year of all-solid-state battery loaded vehicle validation

Ningde Times, BYD, and Guoxuan Hi-Tech all plan to complete the full-solid-state battery vehicle test in 2025.3 The energy density of the first-generation solid-state battery jointly developed by Tsingtao Energy and SAIC Group reaches 368Wh/kg, and the range of the equipped models breaks through 1,083 kilometers, and it is planned that 100,000-vehicle mass production will be realized in 2025.4 The first-generation solid-state battery has been developed jointly with SAIC Group.

Cost down and material breakthroughs

Electrolyte technology: Ganfeng lithium sulfide electrolyte ionic conductivity up to 1.2mS/cm; Vonergy’s semi-solid-state batteries have been set by eVTOL customers.

Cost reduction path: semi-solid state battery cost down to 1 yuan / Wh, full solid state target 2026 down to 2 yuan / Wh. Qingtao Energy claimed that the new generation of products will be 10-30% lower than the cost of lithium iron phosphate battery.

💎 Conclusion: specialization, differentiation to determine the next round of competition

When Geely self-built 70GWh production capacity refers to the sovereignty of the supply chain, when the solid state battery of Qingtao Energy entered the 100,000 mass production track, China’s power battery market has shifted from the “scale of the race” to the “technical deep water” competition.

The logic of competition in 2025 clearly presents three main lines:

The head of the battery factory (Ningde Times, BYD) with CTP technology, solid-state battery layout to consolidate the high-end market;

second-tier enterprises through plug-in hybrid battery, 800V fast charging program to cut into the incremental market;

car battery company to self-supply + open supply dual-mode reconstruction of the industry chain right to speak.

According to SNE forecast, the global solid state battery shipment will reach 614.1GWh in 2030, in this three-dimensional competition consisting of safety, cost and energy density, only the enterprises that master the core material technology (e.g., sulfide electrolyte, silicon carbon negative electrode) and scenario definition capability (e.g., supercharging, low-temperature performance) will be able to win the end-game ticket of the hundred billion-dollar market.